We all want to leave the world a better place than we found it. For many, that desire extends beyond our lifetimes, to the generations who will inherit the planet and its resources. Building a legacy isn’t just about accumulating wealth; it’s about investing in a future where our children and grandchildren can thrive. This means moving beyond traditional investment strategies and embracing ethical and sustainable options.

Ethical investing, also known as responsible investing or sustainable investing, considers environmental, social, and governance (ESG) factors alongside financial returns. It’s about aligning your investments with your values, supporting companies that demonstrate a commitment to positive social and environmental impact, and avoiding those that engage in harmful practices.

But what does this look like in practice? It’s not always straightforward, and it requires some research and understanding. Here are some key areas to consider:

* Environmental Impact: Look for companies actively reducing their carbon footprint, investing in renewable energy, and minimizing pollution. This might involve investing in green technology companies, supporting sustainable agriculture, or avoiding companies with high environmental risks. Consider the impact of their supply chains – are they ethically sourcing materials?

* Social Responsibility: Assess a company’s treatment of its employees, its commitment to fair labor practices, and its engagement with the communities where it operates. Look for companies that prioritize diversity and inclusion, pay fair wages, and avoid exploitative practices.

* Governance: Good governance is crucial for long-term sustainability. This includes factors like transparency, accountability, and ethical leadership. Look for companies with strong corporate governance structures, robust ethical codes of conduct, and a commitment to preventing corruption.

Finding ethical investments might require a shift in your investment approach. You might need to move away from purely profit-driven strategies and embrace a more holistic view. This could involve:

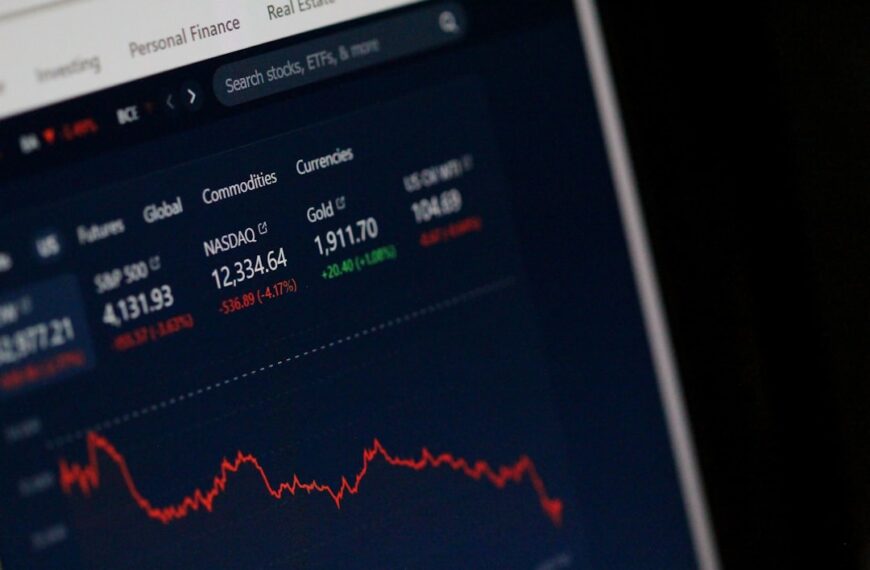

* ESG-focused funds: These funds invest specifically in companies with strong ESG profiles.

* Impact investing: This type of investing aims to generate both financial returns and positive social or environmental impact.

* Socially responsible ETFs (Exchange-Traded Funds): These offer diversified exposure to companies meeting specific ethical criteria.

* Direct investment in ethical companies: Researching and investing directly in companies that align with your values.

It’s also important to remember that ethical investing isn’t about sacrificing returns. While past performance isn’t indicative of future results, many studies suggest that ESG factors can be positively correlated with long-term financial performance. Companies with strong ESG profiles often demonstrate better risk management, greater resilience to market fluctuations, and enhanced brand reputation.

Building a legacy through ethical investing is a journey, not a destination. It requires research, critical thinking, and a commitment to long-term sustainability. But by aligning your investments with your values, you can create a more sustainable future for yourself, your family, and generations to come. The rewards are not only financial, but also deeply personal, knowing you’re contributing to a better world.