We all crave that feeling of financial freedom, that blissful state where money isn’t a constant source of stress. But achieving this “budgeting bliss” often feels elusive. We dream of exotic vacations, the latest gadgets, and comfortable financial cushions, but the reality of limited income frequently clashes with our desires. The key, surprisingly, lies in the seemingly simple, yet powerfully effective word: “no.”

Learning to say “no” isn’t about being a miser or depriving yourself of all enjoyment. It’s about making conscious choices that align with your financial goals. It’s about prioritizing your long-term well-being over instant gratification.

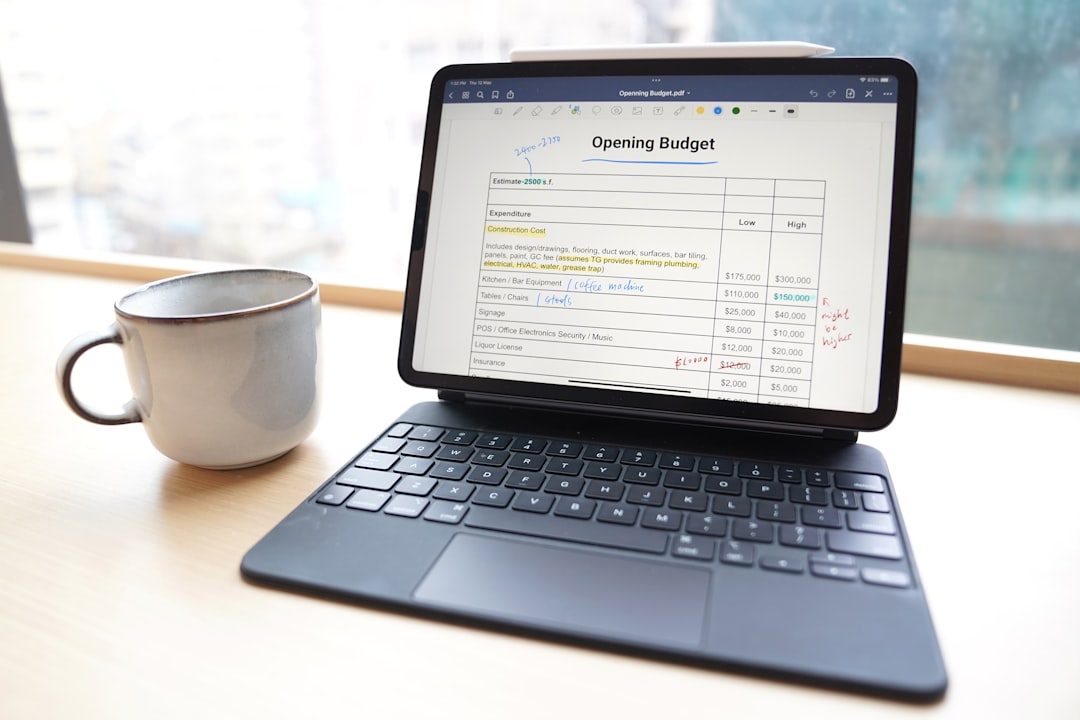

Think about it: how many times have you spent money on something you didn’t truly need? That impulse purchase at the checkout, the subscription you barely use, the expensive coffee every morning – these little expenses, when added up, can significantly impact your budget. Saying “no” to these seemingly insignificant expenditures is where the magic happens.

Saying “no” doesn’t require drastic lifestyle changes. It’s about making small, intentional shifts. Start by tracking your spending for a week. Identify those areas where you’re overspending. Then, consciously decide where you can cut back. Can you pack your lunch instead of eating out? Can you cancel that unused streaming service? Can you find free or low-cost alternatives for entertainment?

Saying “no” also extends beyond material possessions. It’s about saying “no” to commitments that drain your time and energy, preventing you from pursuing higher-paying opportunities or side hustles that could boost your income. Learning to prioritize your time and resources is just as crucial as managing your finances.

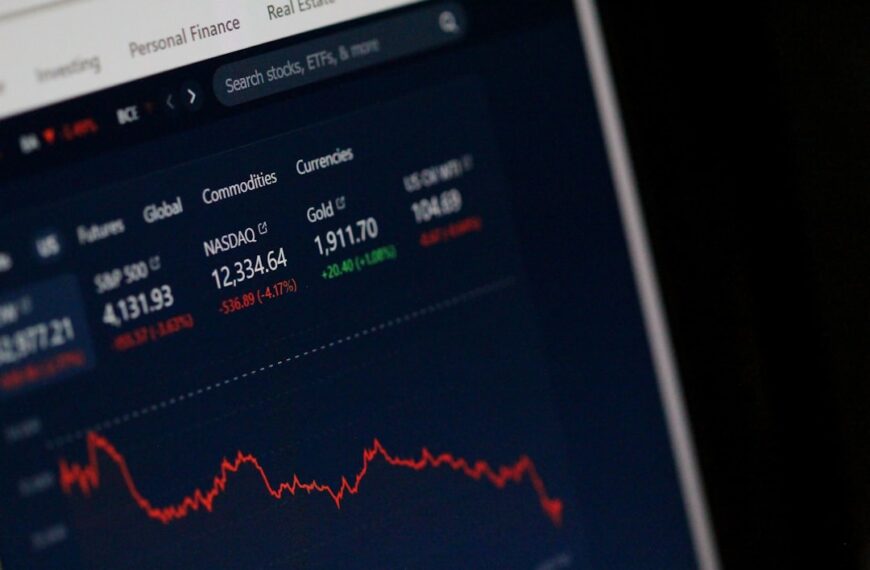

The power of “no” isn’t about restriction; it’s about empowerment. By strategically saying “no” to unnecessary expenses and time-wasting activities, you’re freeing up resources – both financial and personal – to invest in what truly matters. You’re creating space for experiences that bring you genuine joy and contribute to your long-term financial security.

Mastering the art of saying “no” isn’t easy. It requires self-discipline and a clear understanding of your financial priorities. But the rewards are well worth the effort. By embracing the power of “no,” you’ll pave the way to a more financially secure and, ultimately, more blissful future. So, start practicing. Say “no” to impulse buys, say “no” to unnecessary commitments, and say “yes” to a future where budgeting is a source of peace, not stress.