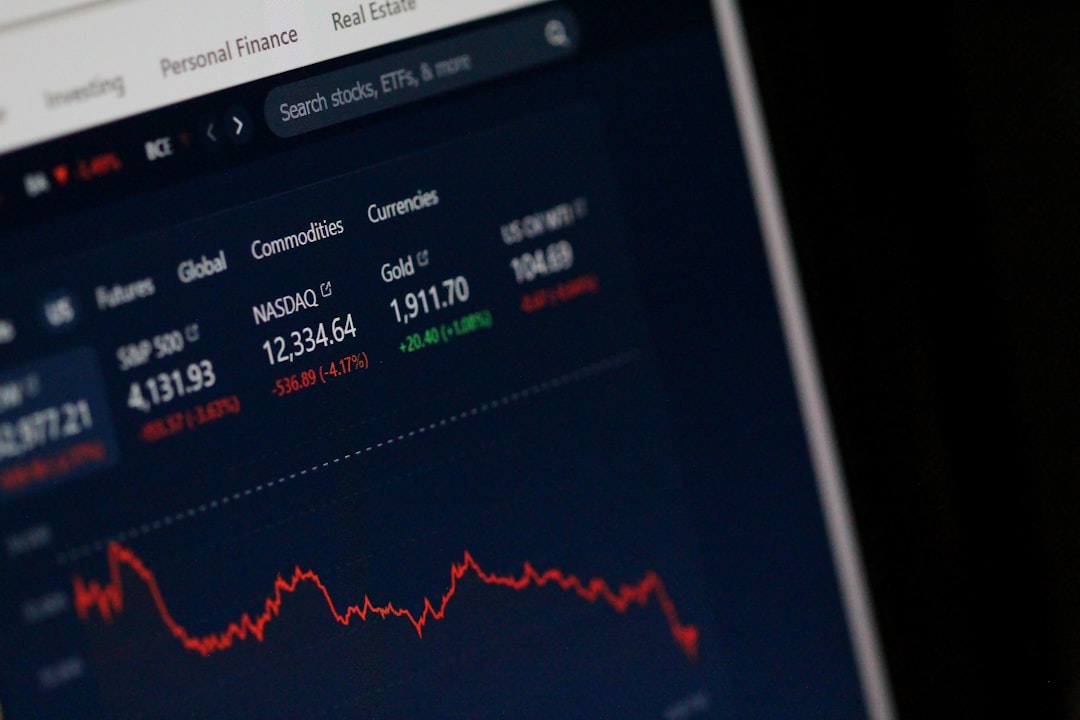

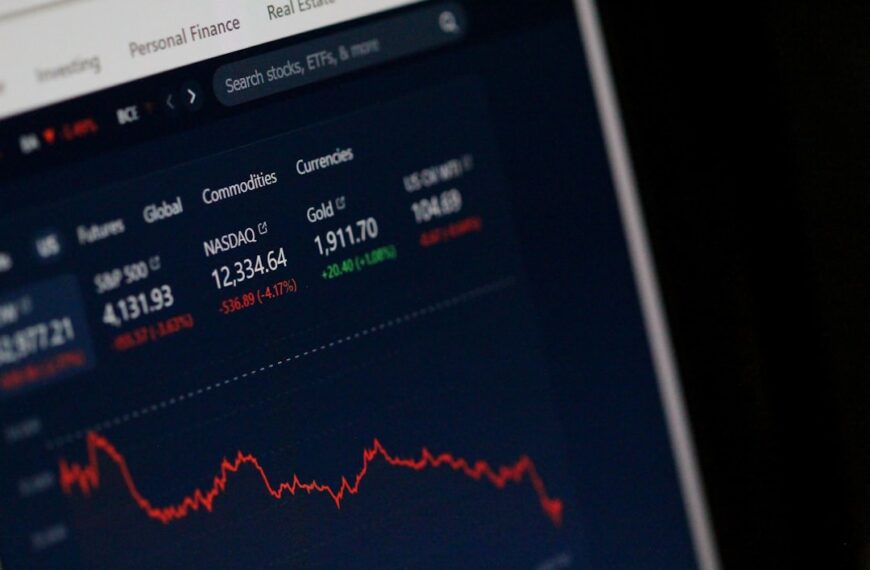

Market volatility. The words alone can send shivers down the spine of even the most seasoned investor. Images of plummeting stock prices and panicked selling flood the mind. But what if I told you that volatility, while undeniably risky, also presents incredible opportunities for profit? This isn’t about reckless gambling; it’s about understanding the mechanics of market fluctuations and employing strategies to navigate them successfully.

The key lies in shifting your perspective. Instead of viewing volatility as an enemy, see it as a dynamic landscape offering unique advantages. During periods of high volatility, prices fluctuate wildly, creating both buying and selling opportunities that are less pronounced in stable markets. This opens the door for savvy investors to capitalize on these price swings.

One effective strategy is options trading. Options contracts allow you to buy or sell the right, but not the obligation, to trade an underlying asset at a specific price within a certain timeframe. In volatile markets, the value of options contracts can skyrocket, significantly amplifying potential gains – but also losses, making careful risk management paramount. Thorough research and a deep understanding of options strategies are crucial before venturing into this area.

Another approach is to focus on fundamentally strong companies. While the overall market may be turbulent, robust companies with solid financials and a strong competitive advantage often weather the storm better than their weaker counterparts. This presents an opportunity to buy shares of these companies at a discounted price during a market downturn, knowing that their long-term value is likely to recover. Patience is key here; you’re playing the long game.

Diversification is also crucial. Don’t put all your eggs in one basket. Spread your investments across different asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate risk. A diversified portfolio can help cushion the impact of volatility on your overall investment returns.

However, it’s crucial to acknowledge the inherent risks. Volatility can lead to significant losses if you’re not careful. Never invest more than you can afford to lose, and always have a well-defined exit strategy. Consider setting stop-loss orders to limit potential losses, and don’t panic sell during market dips. Emotional decision-making is the enemy of successful investing.

Furthermore, staying informed is paramount. Keep abreast of market trends, economic indicators, and geopolitical events that might influence market movements. This allows you to make more informed decisions and react appropriately to changing market conditions. Reliable news sources and financial analysis tools are invaluable resources.

Riding the rollercoaster of market volatility is not for the faint of heart. It demands discipline, a deep understanding of market dynamics, and a risk-tolerant approach. But for those willing to learn and adapt, it can be a rewarding journey, offering the potential to profit from the inevitable ups and downs of the financial markets. Remember, thorough research, careful planning, and disciplined execution are the keys to success.