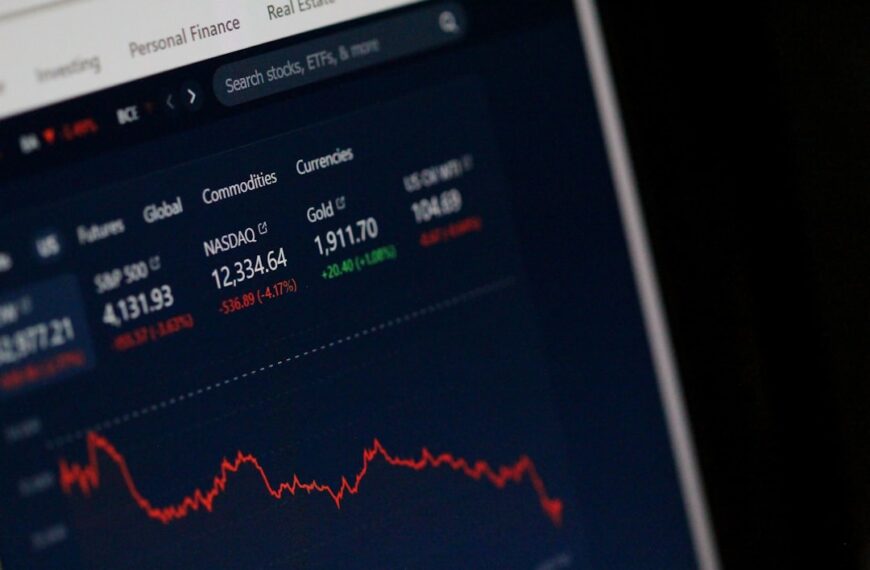

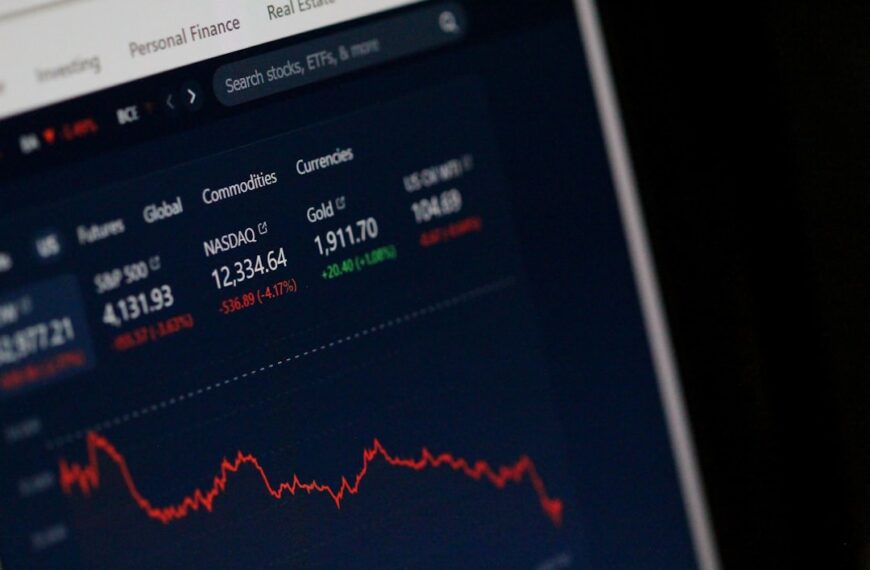

For decades, investors seeking reliable income have looked to dividend-paying stocks. But not all dividend stocks are created equal. Some companies pay out dividends sporadically, adjusting them based on short-term market fluctuations or unexpected financial events. This can make relying on that income stream unpredictable and potentially unstable. That’s where Dividend Aristocrats come in.

Dividend Aristocrats are companies that have increased their dividend payments annually for at least 25 consecutive years. This remarkable track record speaks volumes about their financial strength, consistent profitability, and commitment to shareholder returns. Investing in Dividend Aristocrats isn’t about chasing the highest yield; it’s about building a portfolio of financially sound companies that are committed to long-term, sustainable growth and dependable income.

What makes a Dividend Aristocrat so attractive? Let’s delve into some key benefits:

* Stability and Reliability: The most significant advantage is the consistent dividend growth. This provides a predictable income stream, crucial for retirees or anyone looking for a stable source of funds. The sustained dividend increases offer a hedge against inflation, ensuring your income maintains purchasing power over time.

* Financial Strength: Companies that have increased dividends for 25+ years have generally proven their ability to weather economic downturns. They’ve demonstrated resilience and a robust business model capable of generating consistent profits, even during challenging periods. This financial fortitude translates to lower investment risk compared to companies with erratic dividend payouts or no dividend at all.

* Long-Term Growth Potential: While income is a primary focus, Dividend Aristocrats are not solely about dividends. Many are established, blue-chip companies with solid long-term growth prospects. Their consistent profitability allows them to reinvest in their businesses, driving innovation and expansion, contributing to both dividend growth and capital appreciation.

* Reduced Volatility: While no investment is entirely risk-free, Dividend Aristocrats tend to exhibit lower volatility than the broader market. Their stable earnings and consistent dividend payments can provide a buffer against market fluctuations, offering a degree of protection during periods of market uncertainty.

Building Your Dividend Aristocrat Portfolio:

While the appeal is undeniable, it’s crucial to approach investing in Dividend Aristocrats strategically. Don’t simply invest in the first few companies you find. Consider the following:

* Diversification: Don’t put all your eggs in one basket. Diversify your portfolio across various sectors to mitigate risk.

* Payout Ratio: Analyze the payout ratio (percentage of earnings paid out as dividends). A healthy payout ratio ensures the company can sustain its dividend payments without compromising its future growth.

* Debt Levels: Examine the company’s debt-to-equity ratio. High debt levels can indicate financial instability and could threaten future dividend increases.

* Future Growth Prospects: Evaluate the company’s growth potential. While consistency is key, future prospects influence long-term dividend growth.

* Valuation: Don’t overpay. Analyze the company’s valuation metrics (e.g., Price-to-Earnings ratio) to ensure you’re getting a reasonable price for your investment.

Investing in Dividend Aristocrats requires research and a long-term perspective. It’s not a get-rich-quick scheme, but rather a strategy for building a portfolio that provides reliable income growth and potentially significant capital appreciation over time. By carefully selecting companies with a strong track record, sound financials, and promising future prospects, you can create a portfolio that provides a secure and growing income stream for years to come. Remember to consult with a financial advisor before making any investment decisions.