Inflation. It’s a word that’s become increasingly familiar, and unfortunately, increasingly concerning. Rising prices are impacting everyone, from the cost of groceries to the price of gas, leaving many feeling squeezed and uncertain about the future. But navigating this challenging economic climate doesn’t have to be overwhelming. By understanding inflation and taking proactive steps, you can protect your finances and mitigate its impact on your life.

First, let’s clarify what inflation is. Simply put, it’s the rate at which the general level of prices for goods and services is rising and, subsequently, purchasing power is falling. When inflation is high, your money buys less than it did before. This isn’t just about feeling like things are more expensive; it’s a real erosion of your financial stability.

So, what can you do? The key is to be proactive and strategic. Here are some practical steps to take:

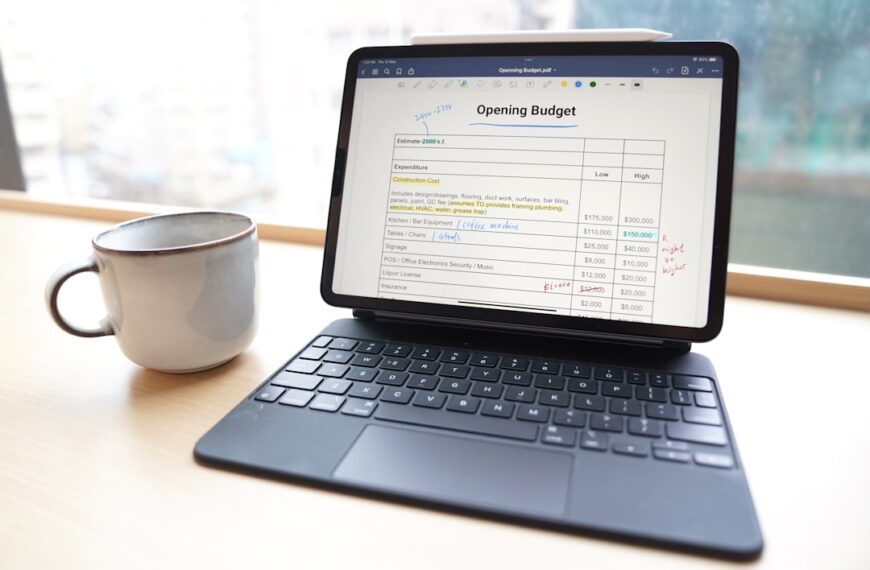

1. Track Your Spending: The first step to controlling your finances is understanding where your money is going. Use budgeting apps, spreadsheets, or even a simple notebook to meticulously track your income and expenses. This will highlight areas where you can cut back and identify potential savings.

2. Identify Non-Essential Expenses: Once you have a clear picture of your spending habits, analyze your expenses and identify areas where you can reduce spending without significantly impacting your quality of life. This could involve cutting back on dining out, entertainment, subscriptions, or impulse purchases.

3. Negotiate Bills and Rates: Don’t be afraid to negotiate with your service providers, such as your internet, phone, or insurance companies. Many are willing to offer discounts to retain customers. Similarly, shop around for better rates on loans and credit cards.

4. Diversify Your Savings: Don’t put all your eggs in one basket. Diversify your savings across different accounts, including high-yield savings accounts, money market accounts, and potentially, investments (after consulting with a financial advisor). This strategy helps to protect your savings from inflation’s erosive effects.

5. Consider Investing: While investing carries risks, it’s crucial to consider it as a long-term strategy to outpace inflation. Stocks, bonds, and real estate can potentially offer returns that exceed inflation, helping to preserve your purchasing power. Remember to seek professional advice before making any investment decisions.

6. Pay Off High-Interest Debt: High-interest debt, such as credit card debt, can significantly hinder your financial progress. Prioritize paying it off as quickly as possible to free up more of your income and reduce the overall financial strain.

7. Increase Your Income: Explore opportunities to increase your income, such as taking on a side hustle, negotiating a raise, or acquiring new skills that command higher salaries.

8. Stay Informed: Keep yourself updated on economic news and inflation rates. Understanding the trends can help you make informed financial decisions.

Inflation is a complex issue, but by being proactive, knowledgeable, and strategic, you can effectively navigate these challenging times and protect your financial well-being. Remember, small, consistent efforts can make a significant difference in the long run. Don’t hesitate to seek advice from a qualified financial advisor if needed. They can provide personalized guidance and help you develop a comprehensive financial plan to weather the storm.