We all know the unconditional love and companionship our pets provide, but have you considered the less fuzzy, more financial aspects of pet ownership? It’s easy to focus on the adorable puppy eyes and playful kitten antics, but the truth is, owning a pet has a surprisingly significant impact on our finances – and it’s not always negative. In fact, there’s a whole new field of study emerging around this very topic: the economics of pet ownership.

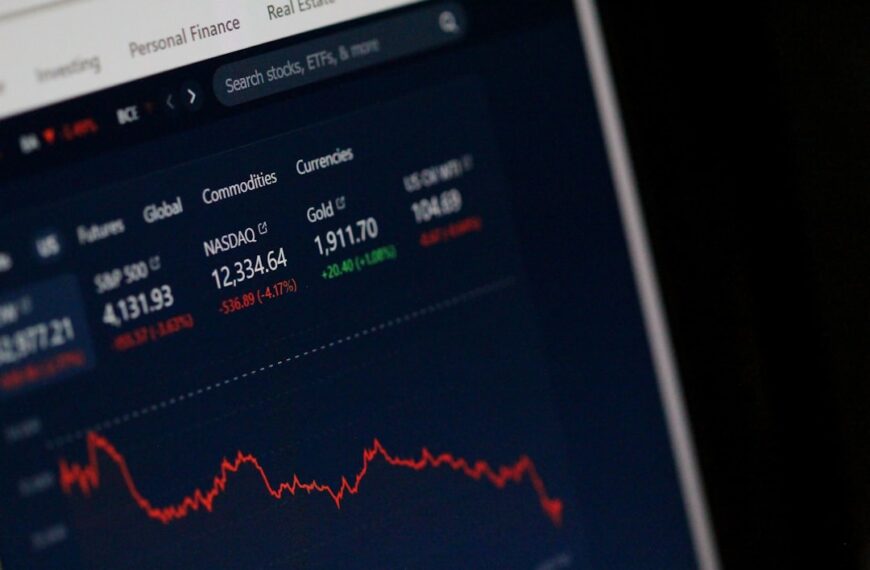

Let’s start with the obvious expenses. Food, vet bills, toys, grooming – these costs can quickly add up. The initial adoption or purchase price is just the beginning. Unexpected illnesses or injuries can lead to hefty veterinary bills, potentially impacting your savings significantly. Regular flea and tick prevention, along with pet insurance (a worthwhile investment for many), adds another layer to the budget.

However, the narrative isn’t solely about expenses. Recent studies are revealing a fascinating counterpoint: the positive financial impact of pet ownership. For example, pet owners often report increased spending in related areas. This includes pet-sitting services, specialized pet food stores, and even pet-friendly travel accommodations. This increased spending stimulates local economies and creates jobs.

Beyond the direct economic effects, there’s a compelling case to be made for the indirect benefits. Studies suggest a correlation between pet ownership and improved mental health. Reduced stress and anxiety can lead to increased productivity at work, resulting in greater earning potential. This improved well-being can also translate into reduced healthcare costs in the long run, as healthier individuals require less medical attention.

Furthermore, pets can even play a role in our social lives. They act as social catalysts, leading to increased interaction with other pet owners in parks, at dog walks, or even online through pet communities. This can lead to new friendships and networking opportunities, which can have unexpected professional and financial benefits.

Finally, the value of companionship shouldn’t be overlooked. For many, the emotional support provided by a pet is priceless. While difficult to quantify financially, this emotional well-being can indirectly contribute to a more fulfilling and productive life, positively impacting overall financial stability.

In conclusion, while the financial responsibilities of pet ownership are undeniable, it’s crucial to consider the broader economic picture. From stimulating local businesses to improving mental health and boosting productivity, the impact of our furry friends extends far beyond the cost of a bag of kibble. It’s a complex interplay of expenses and benefits, reminding us that the pawsitive economics of pet ownership are far more nuanced than we might initially assume. So, the next time you’re cuddling with your beloved pet, remember the surprisingly significant – and often positive – impact they have on your finances, and the world around you.