Coming into a sudden inheritance can feel like winning the lottery – a whirlwind of excitement, relief, and endless possibilities. But the reality often differs sharply from the initial euphoria. This isn’t to say inheriting money is inherently bad; far from it. It can be a life-changing opportunity. The challenge lies in navigating the “inheritance paradox”: the clash between the sudden influx of wealth and the desire for a steady, fulfilling life.

Many inheritors find themselves overwhelmed. The sheer amount of money can be paralyzing, leading to indecision and missed opportunities. Should you invest it all? Pay off debts? Buy a dream home? Start a business? The pressure to make the “right” decisions, coupled with the fear of making the wrong ones, can be incredibly stressful. This is further complicated by the emotional weight of the inheritance itself – a reminder of loss and the often-complex relationships involved.

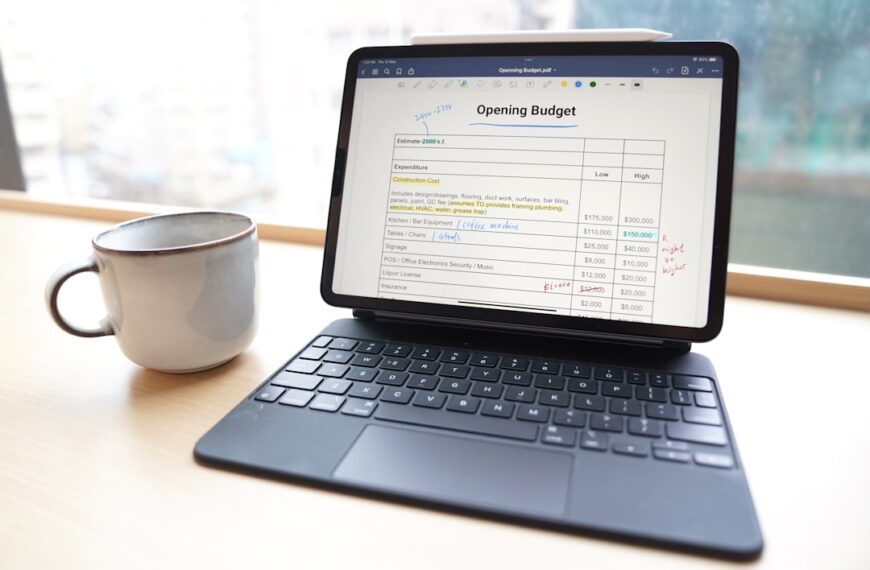

Then there’s the risk of lifestyle inflation. Suddenly having more disposable income can lead to increased spending, eroding the long-term benefits of the inheritance. That new car, the extravagant vacation, the impulse buys – they all chip away at the principal, potentially leaving you worse off than before. Careful budgeting and financial planning become paramount, but this can be difficult to implement when grappling with the emotional rollercoaster of a significant inheritance.

Beyond the financial aspects, the inheritance can strain relationships. Family disputes over the distribution of assets are common, leading to fractured bonds and lasting resentment. Transparency and clear communication are vital to mitigating these risks, ideally with professional guidance. Legal and financial advisors can help navigate complex family dynamics and ensure a fair and equitable distribution, minimizing conflict and preserving relationships.

Successfully navigating the inheritance paradox requires a proactive and thoughtful approach. It’s crucial to take time to process the emotional implications, seek professional advice from financial planners and lawyers, and develop a robust financial plan that aligns with your long-term goals. This plan should account for both immediate needs and long-term security, incorporating strategies for investment, debt management, and charitable giving – if that aligns with your wishes.

The key is to find a balance between embracing the opportunities presented by the inheritance and maintaining a steady, sustainable lifestyle. Sudden wealth shouldn’t define you; it should empower you to build a future that reflects your values and aspirations. With careful planning, mindful spending, and the right support, you can transform a sudden fortune into a foundation for a truly steady and fulfilling life.