Are you ready to take control of your financial future but find the world of investing intimidating? You’re not alone. Many people feel overwhelmed by complex terms and endless options. The good news is, getting started with investing doesn’t have to be complicated. In fact, it’s one of the most crucial steps you can take to build long-term wealth and achieve your financial goals.

At Here Is Money, we believe in making personal finance clear and accessible. This guide, “Investing 101: Your Simple Guide to Stocks, ETFs, and Index Funds,” is designed to cut through the jargon and equip you with the fundamental knowledge you need to start your investing journey with confidence. We’ll explore three popular investment vehicles – stocks, Exchange-Traded Funds (ETFs), and index funds – giving you the foundational investing basics to make smarter decisions.

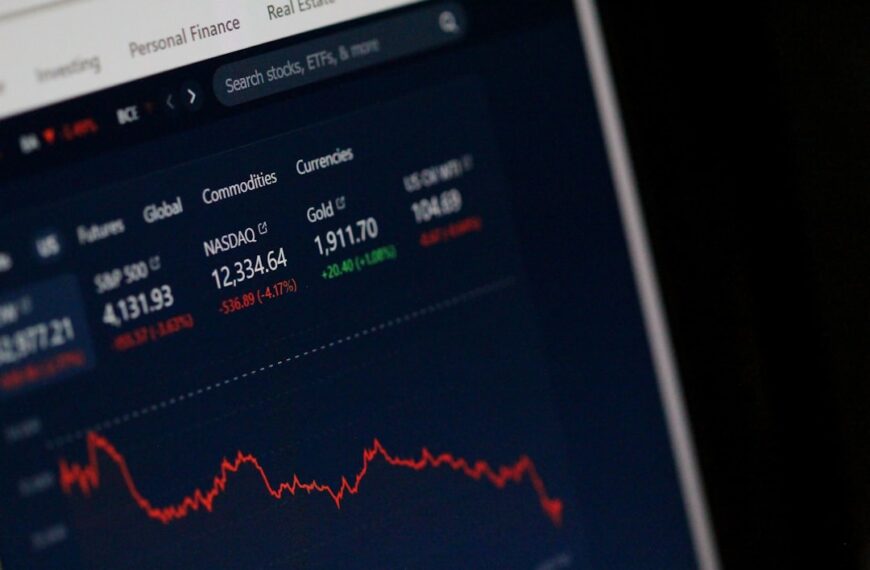

Understanding the Basics: Risk and Return

Before diving into specific investments, it’s essential to grasp the fundamental concept of risk and return. In simple terms, risk is the possibility that your investment may lose money or not perform as expected. Return is the profit or loss made on an investment. Generally, investments with the potential for higher returns also come with higher risks. Finding the right balance for your comfort level and financial goals is key.

It’s important to remember that investing is a long-term game. While market fluctuations are normal, a diversified portfolio and a consistent approach can help mitigate risks over time.

Stocks: Owning a Piece of the Company

What are Stocks and How Do They Work?

When you buy a stock, you’re purchasing a small ownership share, or ‘equity,’ in a publicly traded company. Companies issue stocks to raise capital for their operations, expansion, or other initiatives. As an owner, you have a claim on the company’s assets and earnings. The value of your stock typically fluctuates based on the company’s performance, industry trends, and overall market sentiment. If the company thrives, the value of your shares may increase, and you could also receive dividends – a portion of the company’s profits paid out to shareholders.

Benefits and Risks of Stock Investing

Benefits:

- High Growth Potential: Historically, stocks have offered higher long-term returns compared to other asset classes.

- Dividends: Many companies pay dividends, providing a regular income stream in addition to potential capital appreciation.

- Direct Ownership: You directly own a piece of a company you believe in.

Risks:

- Volatility: Individual stocks can be highly volatile, with prices changing rapidly due to various factors.

- Company-Specific Risk: A single company’s poor performance, bad news, or even bankruptcy can significantly impact your investment.

- Requires Research: Investing in individual stocks often demands thorough research and understanding of the company and its industry.

ETFs (Exchange-Traded Funds): Diversification Made Easy

How ETFs Pool Investments

Exchange-Traded Funds (ETFs) are investment funds that hold a collection of assets, such as stocks, bonds, or commodities. Think of an ETF as a basket containing many different investments. When you buy a share of an ETF, you’re essentially buying a tiny piece of that entire basket. This immediately provides diversification because your money is spread across numerous underlying assets, rather than just one.

One key feature of ETFs is that they trade on stock exchanges throughout the day, much like individual stocks. This provides flexibility for investors to buy and sell shares at market prices.

Advantages of ETFs for Beginners

ETFs are an excellent option for investing for beginners due to several advantages:

- Instant Diversification: With a single purchase, you gain exposure to a broad market, industry, or asset class, reducing the risk associated with individual stock picking.

- Lower Costs: ETFs typically have lower expense ratios (annual fees) compared to actively managed mutual funds.

- Flexibility: You can buy and sell ETFs throughout the trading day, similar to stocks.

- Transparency: Most ETFs disclose their holdings daily, so you always know what you own.

Index Funds: Tracking the Market

What is an Index and How Do Funds Track It?

An index is a theoretical portfolio of investment holdings that represents a segment of the financial market. For example, the S&P 500 is an index that tracks the performance of 500 of the largest U.S. publicly traded companies. An index fund is a type of mutual fund or ETF designed to passively track the performance of a specific market index.

Instead of relying on a fund manager to pick winning stocks (as in actively managed funds), index funds simply aim to mirror the composition and performance of their chosen benchmark index. If the S&P 500 goes up by 1%, an S&P 500 index fund aims to go up by approximately 1% (minus small fees).

Why Index Funds are a Favorite for Long-Term Investors

Index funds have gained immense popularity, especially among long-term investors, for compelling reasons:

- Low Fees: Because they are passively managed, index funds generally have significantly lower expense ratios than actively managed funds.

- Broad Diversification: By tracking a broad market index, you automatically achieve wide diversification across many companies or asset classes.

- Consistent Performance: Over the long run, many studies show that passive index funds often outperform actively managed funds after fees.

- Simplicity: They offer a straightforward, ‘set it and forget it’ approach to investing.

Getting Started: How to Buy Your First Investment

Ready to put these investing basics into practice? Here’s how to begin:

Choosing a Brokerage Account

To buy stocks, ETFs, or index funds, you’ll need a brokerage account. These accounts are offered by online brokers that act as intermediaries between you and the stock market. When choosing an online brokerage, consider:

- Fees: Look for low or no commission fees on trades.

- Account Minimums: Some brokers require a minimum deposit to open an account.

- Investment Options: Ensure they offer the types of investments you’re interested in (stocks, ETFs, index funds).

- User Interface and Tools: A user-friendly platform and helpful money tools and calculators can make a big difference for beginners.

- Customer Service: Good support can be invaluable when you have questions.

Dollar-Cost Averaging Strategy

One of the smartest strategies for investing for beginners is dollar-cost averaging. This involves investing a fixed amount of money at regular intervals (e.g., $100 every month), regardless of whether the market is up or down. Here’s why it’s so effective:

- Reduces Risk of Bad Timing: You avoid the temptation to try and ‘time the market,’ which is notoriously difficult.

- Buys More When Prices Are Low: When prices are down, your fixed investment buys more shares; when prices are up, it buys fewer. Over time, this can lead to a lower average cost per share.

- Builds Discipline: It establishes a consistent savings and investment habit.

This disciplined approach helps smooth out the natural ups and downs of the market, making your entry into investing less stressful and potentially more rewarding over the long term.

Conclusion: Building Your Investment Foundation

Understanding stocks, ETFs, and index funds is a fantastic starting point for your investment journey. While each has its unique characteristics, all three offer powerful ways to grow your wealth over time. Remember, the key is to start early, invest consistently, and align your choices with your financial goals and risk tolerance.

Don’t let the fear of the unknown hold you back from building a secure financial future. Explore more of our personal finance guides and deepen your understanding of investing topics. Ready to crunch some numbers? Try one of our free money tools and calculators today to see your potential growth, or subscribe to Here Is Money for weekly money tips delivered straight to your inbox. We’re here to help you make smarter money decisions!

FAQ

What’s the main difference between stocks, ETFs, and index funds?

A stock represents ownership in a single company, meaning its performance depends solely on that company. ETFs (Exchange-Traded Funds) are a basket of various assets (like many stocks) that trade like a single stock, offering instant diversification. Index funds are a type of mutual fund or ETF that aims to replicate the performance of a specific market index, providing broad market exposure with low fees.

Is investing in individual stocks too risky for beginners?

Investing in individual stocks can be riskier for beginners due to higher volatility and the need for in-depth research into specific companies. For new investors, ETFs or index funds often provide a more diversified and less volatile entry point into the market, as they spread risk across many holdings.

How much money do I need to start investing in stocks, ETFs, or index funds?

Many online brokerages have no minimums to open an account, and some even allow you to buy fractional shares of stocks and ETFs, meaning you can start with as little as $5 or $10. Index funds (as mutual funds) might have higher minimums, but index ETFs typically do not. The key is to start with what you can afford and invest consistently.

What is dollar-cost averaging and why is it important?

Dollar-cost averaging is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of market fluctuations. It’s important because it helps reduce the risk of buying high by averaging out your purchase price over time. This disciplined approach eliminates the need to time the market and builds a consistent investing habit.

How do I choose between an ETF and an index fund?

Often, the choice comes down to personal preference, as many index funds are now structured as ETFs (index ETFs). Traditional index mutual funds are typically bought and sold once a day at their closing price, while index ETFs trade like stocks throughout the day. ETFs generally have slightly lower expense ratios and more trading flexibility. Both offer excellent diversification and low costs for long-term investors.