Taking control of your money might seem like a daunting task, but it doesn’t have to be. For many, the first and most effective step towards financial freedom is creating a budget. A budget isn’t about restricting yourself; it’s about making informed decisions, understanding where your money goes, and aligning your spending with your financial goals. Whether you’re looking to save for a down payment, pay off debt, or simply gain peace of mind, this ultimate beginner budgeting guide will walk you through everything you need to know. At Here Is Money, we believe that smarter money decisions start with clarity, and budgeting offers just that.

Understanding Your Income and Expenses

Before you can tell your money where to go, you need to know where it’s coming from and where it’s currently going. This foundational step is crucial for any effective personal finance strategy.

Tracking Your Spending: The First Step

Many people are surprised to discover where their money actually goes. Tracking your spending for a month or two is an eye-opening exercise. You can use a simple spreadsheet, a notebook, or even a dedicated budgeting app. The goal is to record every dollar you spend, categorizing each expense as you go. This provides a clear picture of your spending habits and highlights areas where you might be overspending.

Identifying Fixed vs. Variable Costs

Once you’ve tracked your spending, you can begin to distinguish between fixed and variable costs:

- Fixed Costs: These are expenses that generally stay the same each month. Examples include rent/mortgage payments, loan payments (car, student), insurance premiums, and subscriptions. These are often easier to account for.

- Variable Costs: These fluctuate from month to month. Examples include groceries, utilities (which can vary seasonally), entertainment, dining out, and clothing. Variable costs are often where you have the most flexibility to make adjustments in your budget.

Choosing the Right Budgeting Method for You

There isn’t a one-size-fits-all approach to budgeting. The best method is one you can stick with consistently. Here are a few popular and effective strategies for your personal finance guides:

The 50/30/20 Rule Explained

This is a straightforward budgeting method that allocates your after-tax income into three categories:

- 50% for Needs: Essential expenses like housing, utilities, groceries, transportation, and insurance.

- 30% for Wants: Non-essential expenses that improve your quality of life, such as dining out, entertainment, hobbies, and vacations.

- 20% for Savings & Debt Repayment: This includes contributions to an emergency fund, retirement accounts, investments, and any extra payments towards debt.

The 50/30/20 rule is excellent for beginners because of its simplicity and clear guidelines.

Zero-Based Budgeting: Every Dollar Has a Job

With zero-based budgeting, you assign every single dollar of your income a specific job. This means your income minus your expenses should equal zero. It doesn’t mean you spend all your money; rather, it means you’ve intentionally allocated every dollar to a category, whether it’s an expense, savings, or debt repayment. This method demands more attention but provides a deep level of control over your finances.

Envelope System: A Visual Approach

Traditionally, the envelope system involves allocating a specific amount of cash into physical envelopes for various spending categories (e.g., groceries, entertainment, gas) for the month. Once an envelope is empty, you stop spending in that category until the next pay period. While it typically uses cash, digital versions exist through apps. This method is highly effective for those who struggle with overspending in specific variable categories and prefer a tangible approach to managing their money.

Creating Your Budget: A Step-by-Step Walkthrough

Now that you understand your money and have chosen a method, let’s put it into practice.

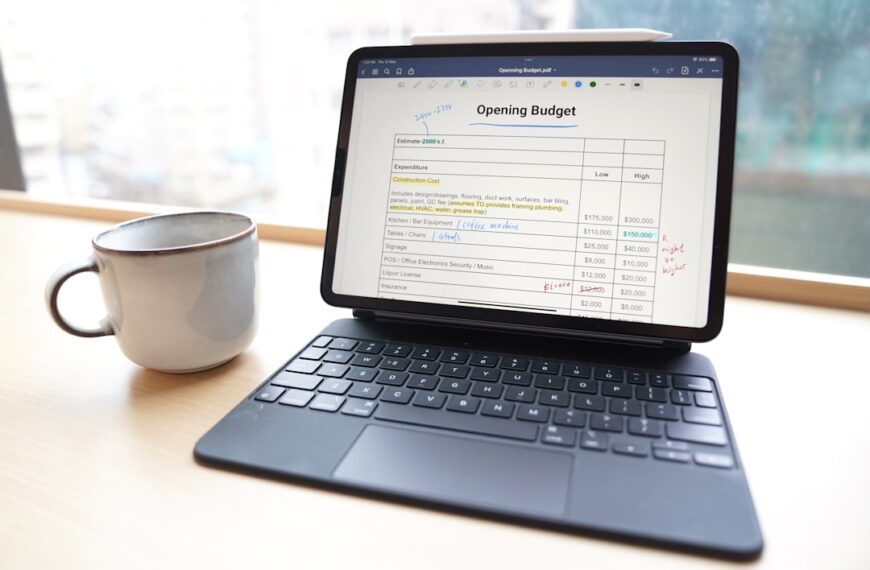

Gathering Your Financial Information

Collect all necessary documents: pay stubs, bank statements, credit card statements, and bills. List all sources of income and all your recurring expenses, both fixed and variable. This will give you the raw data you need to build an accurate budget.

Setting Realistic Goals

What do you want your money to do for you? Set clear, achievable financial goals. This could be saving a certain amount for an emergency fund, paying off a specific debt, or saving for a down payment. Having goals provides motivation and direction for your budgeting and saving efforts.

Allocating Funds

Based on your chosen budgeting method and your financial information, start assigning your income to your expense categories and savings goals. Be realistic about what you can spend in each area. Remember, this is a living document, and you can adjust it as needed.

Sticking to Your Budget: Tips for Success

Creating a budget is only half the battle; consistently following it is key to long-term financial success.

Regular Reviews and Adjustments

Life happens, and your budget needs to reflect that. Review your budget at least once a month. Are your allocations still realistic? Have your income or expenses changed? Don’t be afraid to adjust categories as needed. Regular check-ins help ensure your budget remains a relevant and effective tool.

Automating Savings

One of the easiest ways to ensure you meet your savings goals is to automate them. Set up automatic transfers from your checking account to your savings or investment accounts on payday. This “pay yourself first” strategy ensures that saving is prioritized before other expenses.

Dealing with Unexpected Expenses

Budgeting doesn’t mean you’ll never have unexpected costs. In fact, a good budget anticipates them. Build an emergency fund for these unforeseen events. Even a small amount set aside regularly can make a big difference when a car repair or medical bill pops up, preventing you from derailing your entire budget.

Conclusion: Your Path to Financial Control

Embracing budgeting is an empowering step towards achieving your financial aspirations. It provides clarity, reduces stress, and puts you firmly in control of your money, rather than the other way around. Start simple, be patient with yourself, and remember that every small step contributes to a larger journey towards financial well-being. Ready to put these tips into action? Explore our diverse range of personal finance guides and money tools and calculators to kickstart your journey today. For weekly insights and practical advice on managing your money, consider subscribing to Here Is Money.

FAQ

What is the best budgeting method for beginners?

For beginners, the 50/30/20 Rule is often recommended due to its simplicity. It clearly allocates 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment, making it easy to understand and implement.

How often should I review my budget?

It’s a good practice to review your budget at least once a month. This allows you to track your progress, identify any discrepancies, and make necessary adjustments to ensure your budget remains realistic and effective with your current financial situation.

What if I struggle to stick to my budget?

Don’t get discouraged! Budgeting is a skill that improves over time. Try to identify why you’re struggling – are your goals unrealistic? Are certain categories too restrictive? Adjust your budget as needed, focus on one or two key areas to improve, and consider methods like the Envelope System for better visual control over spending.

Should I include savings in my budget?

Absolutely! Savings should be a non-negotiable part of your budget. Treat savings as a fixed expense, just like rent or a loan payment. Aim to “pay yourself first” by setting aside money for an emergency fund, retirement, or other goals before allocating funds to discretionary spending.

What are fixed vs. variable expenses?

Fixed expenses are costs that generally remain the same each month, such as rent, mortgage payments, or insurance premiums. Variable expenses fluctuate from month to month, like groceries, utilities, entertainment, or dining out. Understanding the difference helps you identify areas where you have more flexibility to cut spending.