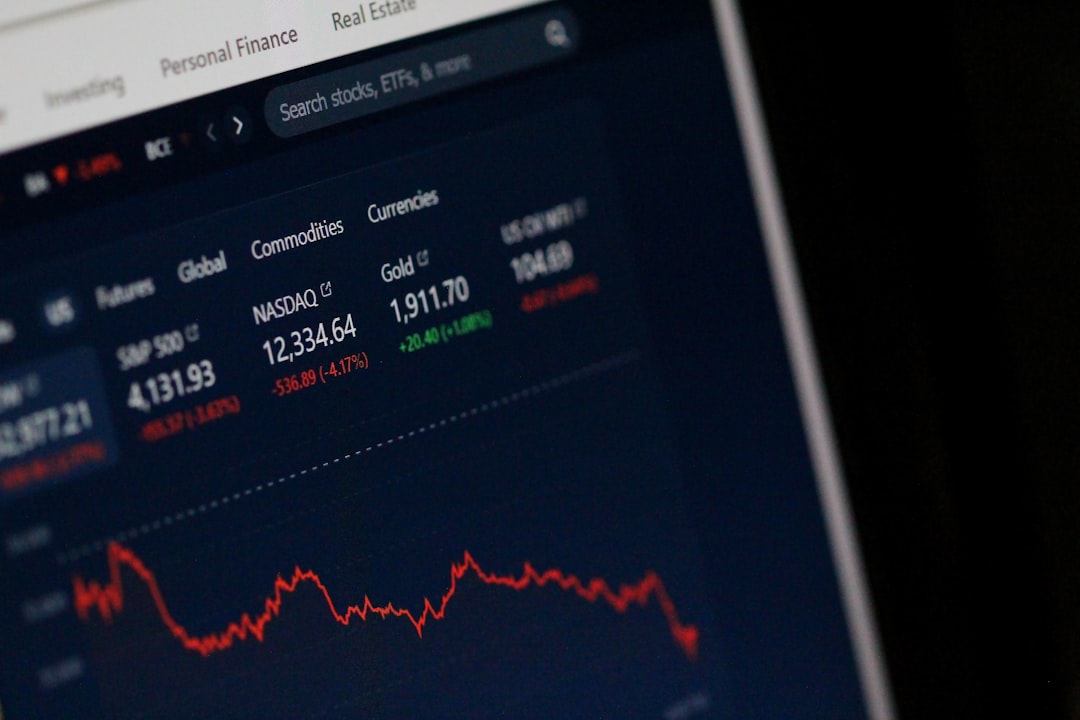

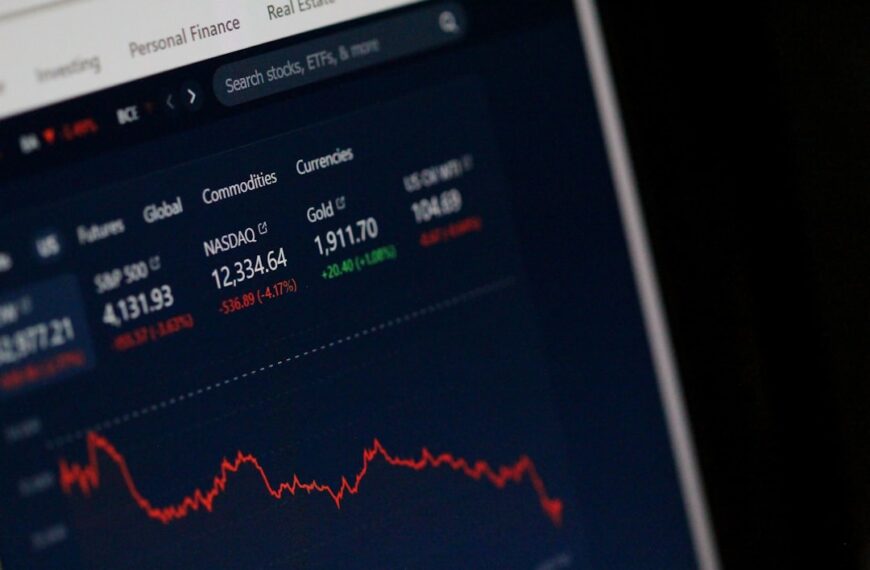

The stock market, a complex beast driven by a multitude of factors, is increasingly influenced by a seemingly unlikely source: social media. Gone are the days when market movements were solely dictated by financial news outlets and expert analysis. Now, the collective sentiment, expressed in the millions of daily posts, comments, and tweets, offers a powerful, albeit noisy, signal. This blog post explores the emerging field of using social media data to predict stock market trends.

The sheer volume of data generated on platforms like Twitter, Facebook, and Reddit is staggering. This data, encompassing everything from individual investor opinions to news dissemination and viral trends, holds valuable clues about market sentiment. Sophisticated algorithms can sift through this data, analyzing language patterns, identifying keywords, and gauging the overall positivity or negativity surrounding specific companies or the market as a whole. This sentiment analysis forms the basis for predictive models.

However, predicting the market based solely on social media sentiment is far from foolproof. The data is inherently noisy. Rumors, misinformation, and emotional outbursts can significantly distort the true picture. Furthermore, the relationship between social media sentiment and actual stock prices is not always straightforward or linear. A surge in positive tweets about a company doesn’t automatically guarantee a stock price increase.

Successful application of this methodology requires careful consideration of several factors. The algorithms used for sentiment analysis must be robust and able to differentiate between genuine expressions of opinion and spam or manipulative postings. Data cleaning and filtering are crucial steps to minimize the impact of noise. Combining social media data with traditional financial indicators, such as earnings reports and economic data, can provide a more comprehensive and reliable predictive model.

Several approaches are being explored. Some researchers focus on analyzing the volume and intensity of social media mentions of specific stocks, treating high volume as a potential predictor of price volatility. Others concentrate on the emotional tone of the messages, using techniques like Natural Language Processing (NLP) to identify positive, negative, or neutral sentiment. Some even go further, examining the network structure of social media conversations to identify influential users whose opinions might disproportionately impact market sentiment.

Despite its challenges, the potential of using social media’s pulse to predict stock market trends is undeniable. As algorithms become more sophisticated and researchers develop more refined methodologies, social media analysis is likely to become an increasingly valuable tool for investors and financial analysts. However, it’s crucial to remember that it should be considered one piece of a larger puzzle, not a silver bullet for predicting market movements. Ultimately, a balanced approach, combining social media sentiment analysis with traditional methods, promises the most accurate and reliable predictions.