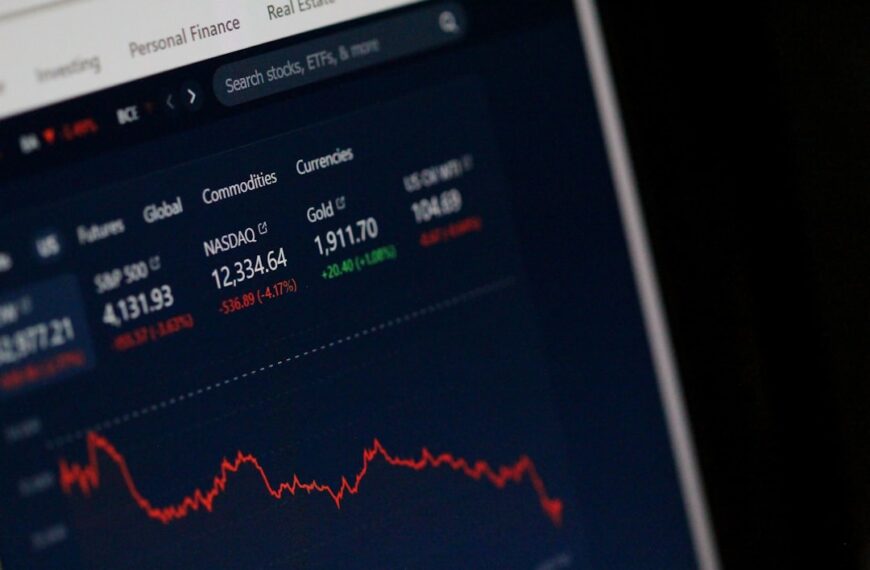

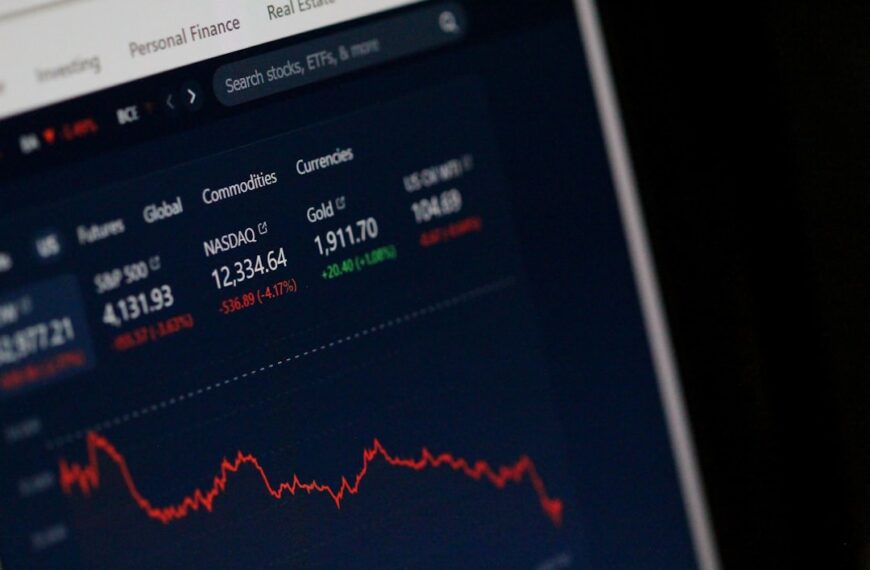

For decades, Wall Street has relied on gut feelings, insider tips, and complex financial models to predict market movements. But a quiet revolution is underway, driven by the immense power of big data. This isn’t about relying on a single indicator; it’s about harnessing the sheer volume, velocity, and variety of data to uncover previously unseen patterns and predict market behavior with unprecedented accuracy.

The traditional approach often overlooks the wealth of information available beyond the balance sheet. Big data incorporates a vastly broader range of inputs, including:

* Social Media Sentiment: The collective mood expressed on platforms like Twitter and Reddit can offer early signals of market shifts. Analyzing the sentiment around specific stocks or sectors can reveal hidden anxieties or excitement that might precede significant price changes.

* Alternative Data Sources: This includes everything from satellite imagery tracking retail parking lots (to gauge consumer spending) to web scraping data reflecting online searches and e-commerce activity. These non-traditional data points can provide a more granular and real-time view of economic trends.

* News and Financial Articles: Natural language processing (NLP) is used to sift through vast quantities of news articles, financial reports, and regulatory filings, extracting key information and sentiment to identify potential market movers.

* Transaction Data: High-frequency trading firms already utilize this, but the scope is expanding. Analyzing massive datasets of buy and sell orders, coupled with other data streams, allows for the identification of subtle market dynamics and potential anomalies.

However, the challenge isn’t just about collecting data; it’s about making sense of it. Advanced machine learning algorithms are critical to this process. Techniques like deep learning, particularly recurrent neural networks (RNNs), are adept at processing sequential data like stock prices over time, identifying complex patterns that would be impossible for humans to discern.

The applications are wide-ranging. Algorithmic trading, already prevalent, is becoming even more sophisticated. Portfolio managers can use big data insights to optimize asset allocation and risk management. Even individual investors can leverage publicly available datasets and user-friendly analytical tools to make more informed decisions.

Despite the potential, it’s important to acknowledge the limitations. Big data is not a crystal ball. Unforeseen events, geopolitical instability, and regulatory changes can all dramatically impact markets. Over-reliance on any single predictive model is risky. Moreover, ethical considerations surrounding data privacy and the potential for market manipulation require careful attention.

The future of stock market prediction lies in the intelligent application of big data. It’s not about replacing human judgment entirely but augmenting it with powerful analytical tools. By combining sophisticated algorithms with expert financial knowledge, we can navigate the complexities of Wall Street with a much clearer understanding of the forces at play. The journey is only beginning, but the potential for transformative change is undeniable.