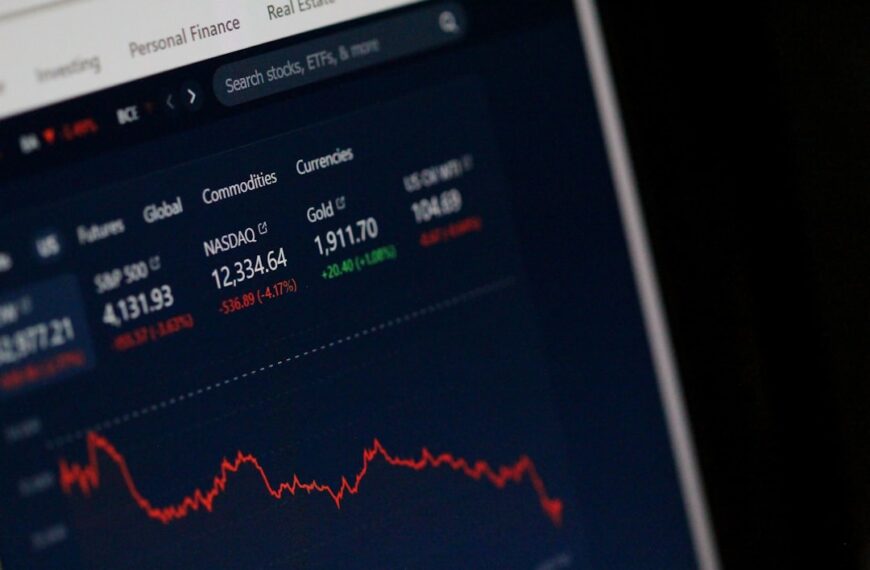

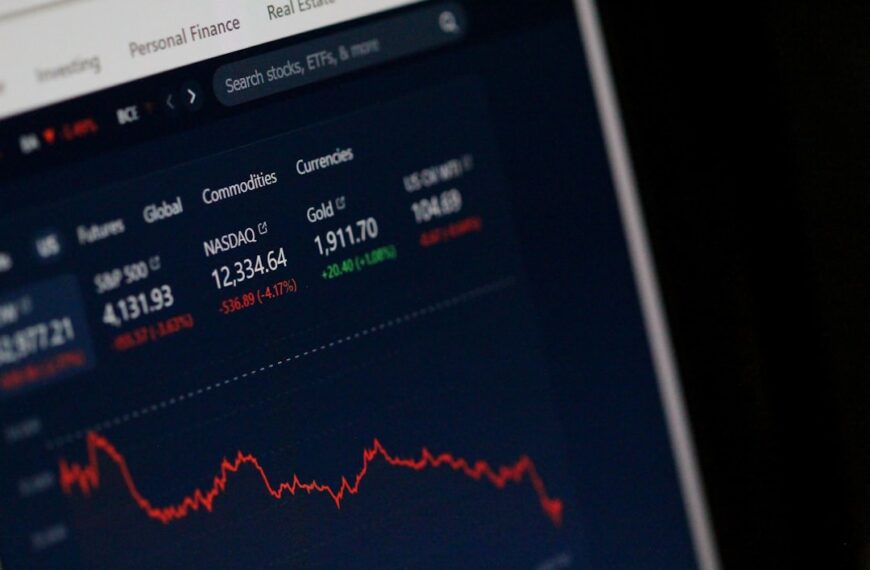

The stock market, a rollercoaster of exhilarating highs and terrifying lows. For most investors, volatility is the enemy; a force to be feared and avoided. But what if I told you that volatility, the very thing that sends chills down the spines of millions, can be a source of immense profit? This is the core principle of contrarian investing, and it’s the focus of this guide.

Fear and greed are the two most powerful emotions driving market movements. During periods of panic, driven by fear, prices plummet irrationally. Conversely, during periods of euphoria, driven by greed, prices skyrocket to unsustainable levels. The contrarian investor recognizes this and acts against the herd. They buy when everyone else is selling and sell when everyone else is buying.

This doesn’t mean being reckless or ignoring fundamental analysis. Successful contrarian investing requires a cool head, a deep understanding of market dynamics, and a robust risk management strategy. It’s not about picking the bottom or the top – that’s impossible – but about identifying undervalued assets during periods of widespread panic and selling when the market has overreacted positively.

Here are some key strategies employed by successful contrarian investors:

* Identify Market Panic: This involves understanding the news cycle, identifying catalysts for fear, and recognizing when the market’s reaction is disproportionate to the actual event. Consider the impact of unexpected economic data, geopolitical events, or even social media trends.

* Focus on Fundamentals: Don’t let fear cloud your judgment. Analyze the fundamentals of the companies you’re interested in. Is the company fundamentally sound, despite the current market downturn? Look at earnings, debt levels, and future growth potential.

* Diversify Your Portfolio: Never put all your eggs in one basket. Diversification helps mitigate risk, ensuring that a downturn in one sector doesn’t cripple your entire portfolio.

* Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of the market price. This smooths out the volatility and reduces the impact of market timing.

* Have Patience: Contrarian investing isn’t a get-rich-quick scheme. It requires patience and discipline. The rewards often come after prolonged periods of uncertainty. You may have to wait for the market to correct itself, but the potential returns can be substantial.

* Manage Your Risk: Never invest more than you can afford to lose. Determine your risk tolerance and stick to it. Stop-loss orders can be crucial for limiting potential losses during unexpected market swings.

Contrarian investing isn’t for the faint of heart. It requires a robust understanding of market psychology, a strong stomach for volatility, and the discipline to stick to your strategy. But for those willing to embrace the challenge, it can be a path to significant long-term gains. Remember, the greatest opportunities often arise from the deepest fears.