Our relationship with money is far more complex than simply adding up numbers. It’s deeply intertwined with our emotions, beliefs, and past experiences, shaping our spending habits and ultimately, our financial well-being. This blog post delves into the psychology of spending and explores how understanding your money mindset can pave the path to financial freedom.

Many of us inherit our financial habits from our families. Did you grow up in a household where money was openly discussed and managed responsibly, or was it a topic shrouded in secrecy and anxiety? These early experiences profoundly influence our adult attitudes towards money. If money was scarce, you might develop a scarcity mindset, characterized by fear of running out and a tendency towards impulsive spending or hoarding. Conversely, those raised in affluent homes may develop a sense of entitlement, leading to overspending and a lack of awareness about the value of money.

Understanding your relationship with money is the first step towards mastering it. Are you a spender, a saver, or something in between? Do you associate money with security, freedom, or perhaps guilt or shame? Identifying your dominant money personality will help you understand your spending triggers and patterns. Common spending triggers include stress, boredom, low self-esteem, and even celebrating achievements. Recognizing these triggers allows you to develop coping mechanisms and make more conscious spending choices.

Cognitive biases also significantly impact our financial decisions. For instance, the “framing effect” shows that how information is presented affects our choices. A sale presented as “50% off” feels more appealing than “50% remaining.” Similarly, the “anchoring bias” makes us overly reliant on the first piece of information we receive, influencing subsequent decisions. Awareness of these biases can help you make more rational financial choices, free from emotional manipulation.

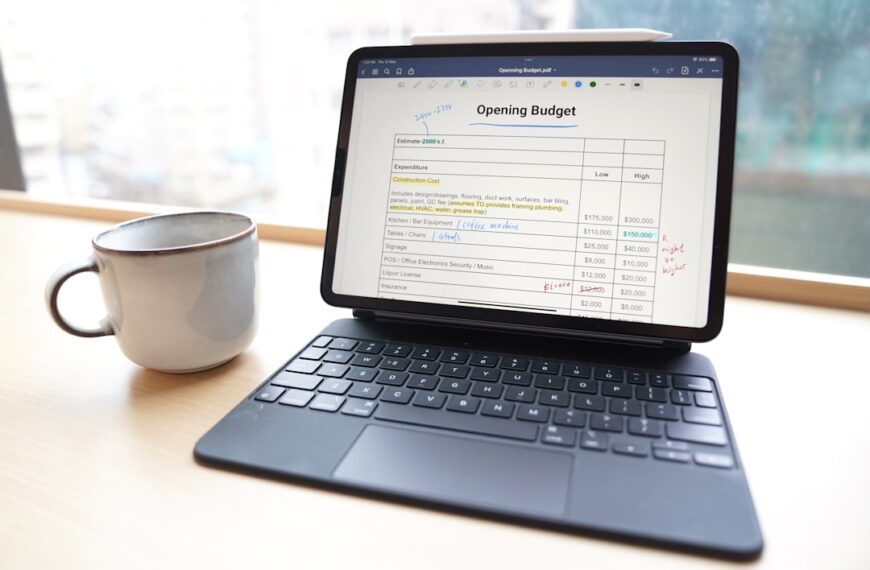

Developing a healthy money mindset involves challenging limiting beliefs and replacing them with empowering ones. This may require introspection, journaling, or even seeking professional help from a therapist or financial advisor. Learning to differentiate between needs and wants is crucial. While satisfying needs is essential, wants often lead to unnecessary spending and debt. Creating a budget, setting financial goals, and regularly tracking your progress are all vital steps in building a stronger financial foundation.

Financial freedom isn’t just about accumulating wealth; it’s about achieving a sense of security and control over your financial life. It’s about aligning your spending habits with your values and goals, allowing you to live a life that is both fulfilling and financially sustainable. By understanding the psychology of spending and consciously working on your money mindset, you can unlock your potential for financial freedom and create a brighter, more secure future. This journey requires self-awareness, discipline, and a commitment to personal growth, but the rewards are immeasurable.