The rise of the gig economy has been touted as a revolution, offering flexibility and independence to millions. But beneath the surface of app-based convenience and entrepreneurial freedom lies a growing concern: are the safety nets traditionally associated with employment – healthcare, retirement savings, unemployment benefits – adequately supporting those who choose this unconventional path? The answer, increasingly, appears to be no.

The gig economy’s inherent structure, built on short-term contracts and independent contractor classifications, often leaves workers without the protections afforded to traditional employees. Sick leave? Forget it. Retirement contributions? A personal responsibility, often unaffordable on fluctuating gig income. Unemployment benefits? Generally inaccessible to those classified as independent contractors. This leaves gig workers incredibly vulnerable to economic shocks, illnesses, and unforeseen circumstances.

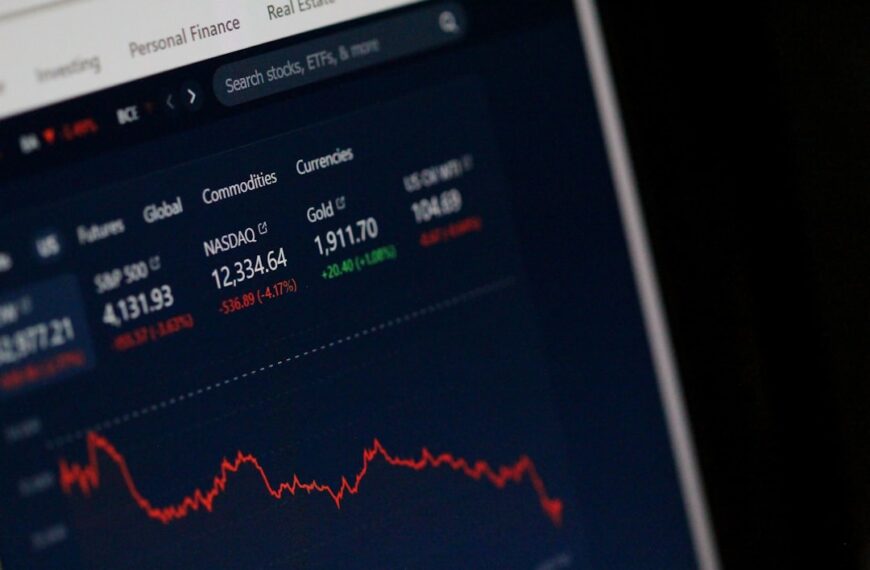

The lack of benefits isn’t just a matter of inconvenience; it’s a significant threat to financial stability. Fluctuations in demand, algorithm-driven pay cuts, and the ever-present threat of platform deactivation can leave gig workers scrambling to make ends meet. The absence of a consistent safety net exacerbates these vulnerabilities, pushing many into precarious financial situations and creating a cycle of instability.

Furthermore, the classification of gig workers as independent contractors often allows companies to avoid paying taxes and other employment-related costs, shifting the burden onto the workers themselves. This further erodes the already fragile financial security of gig workers, leaving them exposed to significant financial burdens.

The narrative of the gig economy as a pathway to entrepreneurial success often overshadows the harsh realities faced by many of its participants. While some undoubtedly thrive, a significant portion struggles, grappling with inconsistent income, lack of benefits, and the constant pressure to maintain a high performance level to secure future gigs.

The question isn’t whether the gig economy will continue to grow – it almost certainly will – but how we address the significant challenges it poses to worker wellbeing. Addressing this requires a multi-pronged approach. Policymakers need to re-evaluate worker classification laws, ensuring gig workers are afforded appropriate protections. Platforms themselves need to take greater responsibility for the wellbeing of their workers, potentially offering benefits packages or contributing to social security programs. And finally, workers themselves need to advocate for their rights and demand better conditions. The current situation is unsustainable; the crumbling safety nets of the gig economy demand immediate attention. Failure to act risks widening the gap between the haves and have-nots, leaving a significant portion of the workforce vulnerable and insecure.